Gujarat’s food sector under scanner: ₹52 cr unaccounted turnover, ₹4.88 cr tax evasion exposed

The Gujarat State Tax Department (SGST) has unearthed a major case of tax evasion in the food and restaurant sector operating under the GST Composition Scheme.

Acting on specific complaints and intelligence inputs, officials first posed as customers at several outlets to check business activity and billing practices. Following this, coordinated search operations were carried out on September 21-22 across 25 premises linked to 16 taxpayers in Ahmedabad, Vadodara, Surat, Gandhinagar, Bhavnagar, Junagadh and Rajkot.

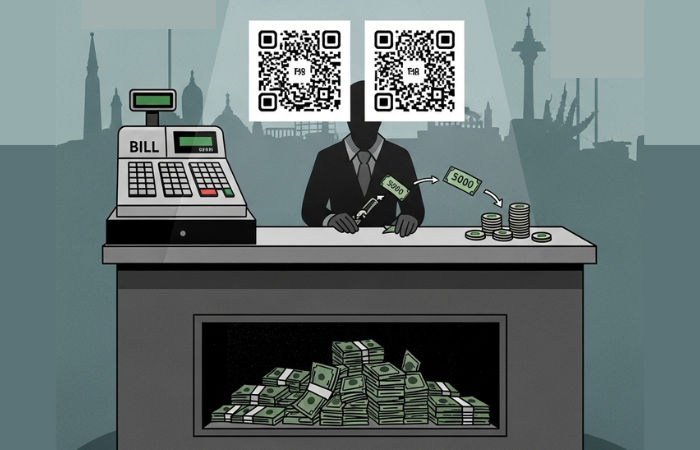

Investigations revealed systematic irregularities — restaurants were found using multiple QR codes to divert payments into undisclosed bank accounts, suppressing sales by not issuing invoices, and deliberately underreporting turnover to stay within the ₹1.50 crore limit to wrongly avail benefits of the Composition Scheme.

According to SGST, unaccounted transactions worth ₹52.07 crore have been detected so far, translating into tax evasion of around ₹4.88 crore including interest and penalty. Recovery proceedings have been initiated along with legal action against those involved.

The case underscores how manipulation of QR codes, fake reporting and suppression of sales are being deployed to evade tax in Gujarat’s food and restaurant sector.