Yuan falls to 17-year low amid escalating US-China trade tensions

The Chinese Yuan dropped to its lowest level against the US dollar since the 2007 global financial crisis, reflecting ongoing pressure from rising trade tensions between Beijing and Washington, as per reports.

The Chinese Yuan dropped to its lowest level against the US dollar since the 2007 global financial crisis, reflecting ongoing pressure from rising trade tensions between Beijing and Washington, as per reports.

According to market data, the onshore Yuan weakened to 7.3518 per dollar during early Thursday trading, its lowest point since December 2007. The offshore Yuan also declined to 7.3592, following a record low of 7.4288 earlier in the week. This month alone, the currency has shed approximately 1.2% of its value.

The People’s Bank of China (PBOC) reportedly set the daily midpoint at 7.2092 on Thursday — its softest level since September 2023. The central bank has reportedly been guiding the Yuan lower in a controlled manner while maintaining reference rates that are stronger than market expectations to avoid excessive volatility.

In response to the weakening Yuan, Chinese authorities have reportedly directed major state-owned banks to limit their purchases of US dollars in an attempt to slow the currency's slide and maintain financial stability.

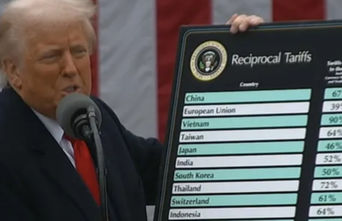

The latest currency moves come as China and the US remain locked in a deepening trade dispute. The US administration recently announced a series of sweeping tariffs targeting around 60 countries, though the measures were paused for all but China. Tariffs on Chinese goods have now reached a cumulative rate of 125%, following several rounds of increases.

Beijing has responded with its set of tariffs and reiterated its intention to defend national economic interests. Chinese officials have criticised the US trade actions and signalled they would take further steps if needed, as per reports.

Analysts say the weakening Yuan may help cushion the impact of US tariffs by making Chinese exports more competitive but warned that significant depreciation could trigger capital outflows and broader financial risks.

As markets continue to watch for any signs of resolution, currency volatility is likely to remain elevated. Observers note that the US-China exchange rate is becoming a key indicator in the broader standoff between the two global powers.